Connect with the Impact Investing Think Tank®

The mission of Impact Investing Think Tank (IITT) is Unleashing More Capital for Good. A program of the Phillips Foundation, IITT convenes and educates investors on the topic of impact investing through speaker series, seminars, workshops and its online hub of curated information and resources. For more information, please email IITT@phillipsfdtn.org.

Cultivating Leaders Through the Impact Fellows Program

Our Impact Fellows program invites eligible MBA and MPA students to join Phillips Foundation for a summer term, academic year or both to experience impact investing in action. Prior fellows include an MBA candidate from UC Berkeley’s Haas School of Business and an MPA student in the School of Public and International Affairs at North Carolina State University. Impact Fellows have continued on to positions at organizations like the Southeastern Council of Foundations and the DRK Foundation. For more information, please email info@phillipsfdtn.org.

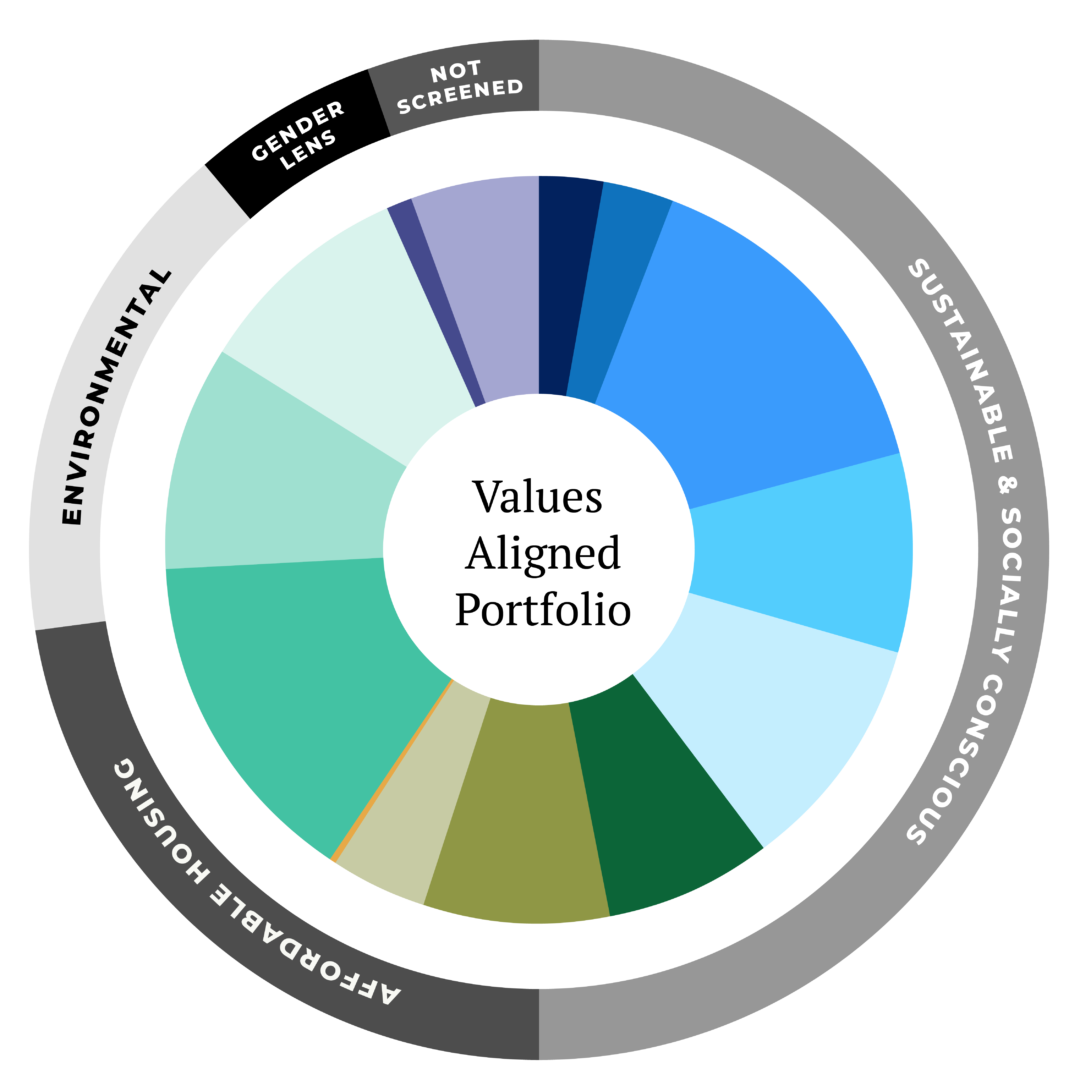

Phillips Foundation Portfolio

Committed to 100% impact

- Participated in several proxy proposals related to board gender diversity, advancing the dialogue on fair executive compensation

- Regularly publish its engagement with management on such efforts

- Hosts around 1,000 company meetings to discuss environmental, social and governance issues

- Participated in industry-wide discussions and projects to improve industry practices

- Collaborated with investors and organizations on addressing environmental, social and governance challenges

- Around 400 holdings that adhere to the benchmark’s strict standards of social and environmental responsibility

- Top Sustainability Sectors in Portfolio by % of Market Value

- Information Technology 27.52%

- Consumer Discretionary 13.95%

- Health Care 12.46%

- Financials 9.96%

- Industrials 9.96%

- Integrated ESG research, shareholder advocacy and public policy advocacy

- Signatory of Principles for Responsible Investing

- Public policy advocacy including multi-year leadership advocating for Say-on-pay included in Dodd-Frank Wall Street reform

- Co-signatory of 5 letters including “We Are Still In” reaffirming Asset Managers commitment to the Paris Climate Agreement

- Supported 47% of shareholder proposals including proxy access, climate change, political lobbying, gender pay equality and linking executive pay to sustainability

Blank

- Exclude issues with business practices that are fundamentally misaligned with sustainability principles

- Evaluate all issuers from an ESG perspective in addition to fundamentals and emphasize those “best-in-class”

- Engage collaboratively with issuers encourage them to improve their ESG practices and influence change

Invest in 3 core industries: healthcare, education and financial services

- 240,000+ patients served

- 14,540,200+ students served

- 13,200+ small businesses served

- Since inception CCM shareholders have helped create roughly $8B of positive community economic development

- $3.5B has been invested in affordable rental housing, translating to approximately 356k individual units

- $329MM+ has been dedicated to investments fostering Enterprise & Job creation

- $400MM has been dedicated to Economic Development

- Net CO2 emissions avoided: 5056 tCO2

- Renewable energy generated: 56,648 MWh

- Water provided/saved/treated: 20 billion gallons

- Materials recovered/water treated: 80,049 tons

- 0% investment in fossil fuel owners & producers

- Reduced exposure to coal, oil & gas producers, automobile manufacturers

- Carbon footprint that is 10.6% less than MSCI ACWI

- Shareholder activism promoting social justice, environment, gender equality

- Comprised of US Large cap companies that are gender diverse

- Companies must have at least one female CEO, chairperson or Board member

- Proxy voting to nominate female Board members

- 33% of Board Seats held by women of companies in the fund vs the global average of 16%

- 27% of senior management positioning held by women of companies within the fund vs the global average of 16%

- 99% of companies in the fund have 2 or more women on their board and 86% have three or more

Impact Investing

At the intersection of profit and purpose

Impact Ventures

Phillips Foundation provided $200,000 in seed capital as a PRI to Impact Ventures to establish North Texas’ first locally-grown and minority-led integrated capital fund for women- and BIPOC-led enterprises. Through this fund, Impact Ventures aims to build generational wealth and improve race and gender equity through inclusive access to capital and mentoring resources.

Draper Richards Kaplan Foundation

Phillips Foundation invested $1 million in the Draper Richards Kaplan Foundation’s portfolio of early-stage, high-impact social enterprises. Our support specifically funds for-profit enterprises led by women and/or people of color, such as BoxPower, a low-cost containerized solar microgrid company serving communities lacking access to an affordable and reliable energy source, and Kinvolved, a virtual communications system between parents and schools which improves parent engagement and student success. (Photo credit: Kinvolved)

Tipping Point Fund on Impact Investing

Phillips Foundation joined the Tipping Point Fund on Impact Investing, a donor collaborative led by the Ford Foundation and aimed at supporting the growth of the impact investing field through strategic grantmaking. The first round of grants has funded eight organizations to catalyze the flow of private capital towards urgent economic, social and environmental challenges.

Community Investment Guarantee Pool

Along with Kresge Foundation, The California Endowment, Chan Zuckerberg Initiative, Annie E. Casey Foundation and other impact investors, the Foundation established a first-of-its-kind unfunded multi-investor guarantee pool to activate investment in community development in the U.S. Launched immediately preceding the COVID global pandemic, this pool (graphic) is helping to rebuild the economy by securing capital for women entrepreneurs and entrepreneurs of color working in affordable housing, climate solutions, and small business management.

LISC (Local Initiatives Support Corporation)

The Foundation invested in the first U.S.-based program-related investment fund targeting the arts, the LISC NYC Inclusive Creative Economy Fund. This fund helps establish and preserve affordable workspaces for businesses in creative industries providing quality jobs for low- and moderate-income people.

Akola

With the backing of our Mission-Related Investment (MRI), this jewelry brand and social enterprise doubled the number of women it employed in Uganda, launched into its first department store, and secured an additional round of growth capital to support continued scaling.

Elsewhere: A Living Museum

The Foundation provided a Program-Related Investment (PRI) to support this Downtown Greensboro museum and artist-in-residency program by collateralizing a commercial loan for its critical building renovations, increasing the organization’s capacity to operate year-round.

MCE Social Capital

We provided a Mission-Related Investment (MRI) to support MCE’s Global Economic Opportunity Notes. MCE’s central focus is to make loans to financial institutions that help people living in poverty in developing nations. Approximately 71 percent of the beneficiaries are women who use the financial services to build assets and start businesses.

RSF Social Finance

As a short-term cash management strategy, the Foundation cycled grant capital through RSF’s 90-day Social Investment Fund prior to annual grant distributions. These assets were loaned to social enterprises around the world. RSF has administered over $300 million in loans since 1984 in the areas of food and agriculture, education and the arts, ecological stewardship, and social finance.

Self-Help Credit Union

We allocated a portion of our fixed-income portfolio to Self-Help through its Women & Children Term Certificate offering, which finances facilities for charter schools and helps women open their first savings accounts, buy a home, afford childcare or start a business. As a CFDI, Self-Help also loans to sustainable businesses including solar farms, recycling businesses, ecotourism, bike shops and more.